A Complete Overview About an Offshore Trust Structure

A Complete Overview About an Offshore Trust Structure

Blog Article

Discover the Benefits of Utilizing an Offshore Trust for Your Financial Safety

If you're checking out methods to bolster your financial safety and security, an overseas Trust might be worth taking into consideration. These frameworks offer distinct advantages, from shielding your properties against financial institutions to offering tax benefits. What else could an offshore Trust do for you?

Recognizing Offshore Trust Funds: What They Are and Exactly How They Work

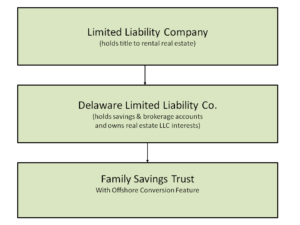

Offshore depends on are effective financial devices that can assist you safeguard your possessions and attain your estate planning objectives. Essentially, an offshore Trust is a lawful setup where you move your assets to a count on located outside your home nation. This setup supplies several benefits, including privacy, flexibility, and prospective tax obligation benefits.

Fundamentally, recognizing just how offshore depends on work can encourage you to make informed economic choices, guaranteeing your properties are managed and distributed according to your desires, no issue where you are in the world.

Possession Defense: Securing Your Riches From Financial Institutions

When it comes to safeguarding your riches from lenders, offshore depends on supply robust legal approaches - offshore trust. They can also give you with crucial personal privacy and discretion advantages, ensuring your monetary info stays safe. By understanding these advantages, you can better protect your properties versus prospective dangers

Legal Security Strategies

While structure wide range is a substantial accomplishment, safeguarding it from prospective creditors is equally essential. An offshore Trust can be an effective legal protection approach. By positioning your properties in such a trust fund, you produce a barrier against financial institutions seeking to declare them. This structure usually falls outside the jurisdiction of your home nation, which includes an additional layer of safety and security.

You can additionally pick a trustee you Trust, that will certainly manage the properties according to your desires, making it harder for creditors to access them. In addition, offshore trusts can aid you preserve control over your wealth while guaranteeing it's secured from lawful activities. This aggressive method to asset security can give you assurance as you build your economic future.

Personal Privacy and Confidentiality Perks

Among the key benefits of developing an overseas Trust is the enhanced personal privacy it uses. With an offshore Trust, your financial events remain personal, providing a layer of protection versus spying eyes. This implies that your properties aren't easily obtainable to creditors or legal entities looking for to claim them. By maintaining your wide range in an offshore jurisdiction, you're additionally reducing the danger of public direct exposure to your financial circumstance.

Moreover, numerous offshore territories have rigorous regulations that protect the privacy of Trust recipients. This can aid you maintain control over your properties without attracting undesirable focus. Ultimately, using an overseas Trust enables you to enjoy your wide range with comfort, understanding that your monetary personal privacy is well-guarded.

Tax Efficiency: Lessening Tax Responsibilities Legally

As you explore offshore depends on, you'll discover a powerful tool for legally lessening tax obligations. These trusts can aid you capitalize on favorable tax territories, allowing you to shield your wide range while decreasing your general tax obligation concern. By positioning your properties in an offshore Trust, you're not simply guarding your monetary future; you're likewise tactically placing yourself to benefit from reduced tax rates and prospective exceptions.

In addition, offshore counts on can give adaptability concerning revenue distribution, enabling you to choose when and just how much to withdraw, which can even more maximize your tax obligation situation. This implies you can manage your revenue in a manner that straightens with your financial goals, lessening taxes while making the most of returns.

Essentially, an offshore Trust supplies a genuine opportunity for enhancing your tax obligation effectiveness, assisting you retain more of your hard-earned money while ensuring conformity with legal requirements.

Personal privacy and Confidentiality: Maintaining Your Financial Matters Discreet

When you establish an overseas Trust, you obtain a considerable layer of personal privacy that safeguards your monetary issues from public examination. This privacy is crucial in today's globe, where monetary information can easily end up being public as a result of lawful proceedings or media exposure. With an offshore Trust, your assets are kept in a jurisdiction with strict confidentiality legislations, guaranteeing that your monetary affairs continue to be discreet.

You control the Trust, which indicates you decide that understands about it and how much they recognize. This degree of discretion not only safeguards you from spying eyes but likewise helps secure your riches from potential legal actions or claims. By keeping your economic matters personal, you maintain peace of mind and control over your legacy. Inevitably, an overseas Trust can be a powerful device for those that value discernment in managing their financial safety and personal privacy.

Estate Planning: Ensuring a Smooth Transfer of Riches

An offshore Trust not just boosts your privacy but also plays a pivotal duty in estate planning, making sure a smooth transfer of wide range to your heirs. By placing your possessions in an overseas Trust, you shield them from potential probate hold-ups and reduce the threat of family disagreements. This framework allows you to specify how and when your heirs obtain their inheritance, offering you with control over your heritage.

In addition, offshore trust funds can aid minimize estate tax obligations, maintaining even more wealth for your enjoyed ones. offshore trust. Overall, an offshore Trust is a tactical device that streamlines estate planning and safeguards your household's monetary future.

Financial Investment Versatility: Increasing Your Financial Opportunities

With an overseas Trust, you get accessibility to a vast array of investment alternatives that can enhance your portfolio. This versatility not just permits for diversification however can also bring about significant tax obligation effectiveness benefits. By strategically choosing your properties, you can maximize your financial opportunities like never previously.

Diverse Asset Options

Although many investors concentrate on conventional properties, offshore trust funds supply varied choices that can substantially improve your financial investment adaptability. By using an overseas Trust, you can access a selection of possession classes, including real estate, personal equity, and antiques. Whether you're interested in arising markets or different financial investments, an overseas Trust can be your gateway to explore these methods.

Tax Performance Benefits

Spending with an offshore Trust not just widens your property choices yet also enhances your tax obligation performance. These depends on frequently run in territories with beneficial tax legislations, allowing you to lessen tax liabilities legally. By purposefully positioning your click to find out more financial investments in an overseas Trust, you can delay tax obligations on funding gains, income, and often even inheritance tax, depending upon the regulations of the Trust's location.

This versatility allows you manage your investments without the hefty tax obligation concern you could encounter locally. And also, you can take benefit of unique financial investment opportunities that could not be available in your home nation. Eventually, an offshore Trust can be a clever relocation for enhancing your monetary approach while keeping more of your hard-earned money helping you.

Picking the Right Territory: Key Considerations for Offshore Counts On

When picking the right jurisdiction for your offshore Trust, recognizing the lawful and tax obligation ramifications is vital. Various countries have differing regulations, tax obligation advantages, and personal privacy legislations that can affect your Trust's effectiveness. You'll want to take into consideration jurisdictions understood for their stability, such as the Cayman Islands, Singapore, or Switzerland.

Review how each location deals with asset protection, as some territories provide more powerful safeguards versus creditors. check that Additionally, explore the simplicity of establishing and keeping your Trust-- some locations have less complex procedures and lower management prices.

Eventually, picking the ideal jurisdiction can significantly improve your Trust's benefits, providing the financial protection you seek. Take your time, do your research study, and seek advice from specialists to make a notified decision.

Frequently Asked Questions

Can I Establish an Offshore Trust Remotely?

Yes, you can establish an overseas Trust from another location. Several jurisdictions enable on-line applications and examinations with neighborhood specialists. Just make certain you comprehend the lawful demands and select a trustworthy solution supplier to assist you.

What Are the Expenses Connected With Developing an Offshore Trust?

When establishing an overseas Trust, you'll run into prices like arrangement fees, yearly upkeep charges, and lawful expenditures. It's vital to budget and understand these prices before proceeding to assure it straightens with your financial objectives.

How Do I Pick a Trustee for My Offshore Trust?

To select a trustee for your overseas Trust, consider their experience, track record, and understanding of your demands. You'll desire a person trustworthy, trusted, and experienced concerning international regulations to guarantee your you could try here possessions are well managed.

Are Offshore Depends On Controlled by International Rules?

Yes, overseas counts on undergo international laws, yet policies differ by jurisdiction. You'll require to research study specific legislations in the Trust's location to guarantee conformity and shield your properties efficiently.

Can I Change the Terms of My Offshore Trust Later On?

Yes, you can change the terms of your offshore Trust later, offered you comply with the guidelines established in the Trust agreement. Simply consult your legal consultant to guarantee you're making the ideal modifications.

Final thought

Including an overseas Trust right into your monetary approach can significantly enhance your wide range security and management. By shielding your properties, lessening tax liabilities, and making sure personal privacy, you're establishing on your own up for a secure financial future. And also, with streamlined estate preparation and increased investment chances, you're not just safeguarding your wealth; you're actively expanding it. So, make the effort to explore your alternatives and select the right territory to make best use of the benefits of your overseas Trust.

Offshore trusts are effective monetary devices that can help you safeguard your possessions and attain your estate intending goals. Basically, an offshore Trust is a lawful setup where you move your assets to a count on situated outside your home nation. By placing your possessions in an overseas Trust, you're not just protecting your monetary future; you're additionally purposefully positioning yourself to benefit from lower tax obligation rates and prospective exceptions.

With an offshore Trust, your properties are held in a territory with strict privacy regulations, guaranteeing that your economic affairs continue to be very discreet.

By tactically placing your financial investments in an overseas Trust, you can delay tax obligations on resources gains, income, and sometimes also estate taxes, depending on the regulations of the Trust's location.

Report this page